If you like this sort of thing then check out my book (only $0.99) – Early Retirement Strategies for The Average Income Earner

I’ve developed a few money saving strategies viz shopping in order to help me reduce my spending – These are as follows:

1. Only allowing myself to shop once every 6 weeks, with the exception of food shopping which I now to once a week.

2. Constructing lists of things I’m going to try and live without for 2015/16 (which I’ll review annually) and also an ‘allowed to buy in 2015’ list.

3. Only food shopping once a week (rather than buying online and dropping in twice a week) – somewhat unexpectedly this has saved me about £50 a month so far this year.

4. Trying to have more non spending than spending days in the year.

5. Keeping track of everything I spend on a daily basis in an excel spreadsheet, analysing this once a month and publishing an overall review of spending once every six months.

The point of all this is because I think it’s more conducive to overall quality of life to not work hard-consume hard, and then work for 40 years. I think it’s better to work hard for 20 years, not consume and then semi-retire at 50 and do constructive non-consumerist things, as outlined here – My early retirement strategy. Anyway – more details on my 5 strategies to help you stop shopping.

Strategy One – On only shopping once every six weeks

Once every six weeks, or thereabouts – that’s my new shopping strategy. The plan is to do one shopping trip/ online purchasing ‘binge’ on the first day of every school holiday, and the reasoning behind this is to stop compulsive shopping and be more in control of my finances. If I want something in the six week build-up, I’ll just put it on a list and then buy it on one of the 7 days I’m now allowing myself to do shopping (I’ve added one in to the end of the summer holiday, given that this is a six week period). This applies not only to shopping but also to browsing and choosing (idle surfing) so this should not only save me money, but time and exposure to advertising.

Strategy Two – Lists I’ve constructed to help me reduce my consumption

The Hold out until 2016/ 2017 list

These are things that I would normally buy because they need replacing (just due to ordinary wear and tear), but I’m trying not to for a year. The longer I can make something last the fewer of them I’ll have to buy throughout my lifetime. Instead of purchasing, I’m going to try and ‘repair put up with’ until it becomes economically irrational to do so.

Also, what I’ve just learnt from populating this list is that there’s very little I actually want/ need anyways!

Hold out until 2016

- New day to day bag for work/ walking

- All shoes except for running shoes.

- New work trousers

- New arm band for musical device

- Headphones

- Books (I’ve got a significant unread pile)

- Ipad

Hold out until 2017 or later

- All running gear except for trainers

- Posh gloves

- Work shoes (Docs)

- Lap Top

- New Winter Jacket the waterproofing on mine’s going

- New Garmin Forerunner (I can’t see it lasting that much longer)

The just do without List

Things I want but I’m just going to try and live without for a longer time. These are just a list of wants I’ve had for a long time. Here I’ll try and find alternatives, or just do without. If I stumble on a windfall, I might buy these!

- Replacement Polar heart rate monitor

- Swanky coffee machine

- Posh netting for fruit cage

The allowed to buy in 2015 allowed list

New things or replacement items I will probably allow myself to my. Most of these are already overdue

- Two new pairs of Asics – £100

- 6 new shirts for work – £40

- Pair of Jeans – £20

- Trip to the dentists – £20

- Trousers for Summer – £20

- Fleece-top for spring/ autumn – £50

- Fleece Jacket – £80

- Propagator (ideally home-made) – £30?

- Paint to redecorate bedroom/ hall and living room – £40

- Fruit trees and bushes (*2) NB – Bought in Feb – £100

- Bike servicing – £50

- Flask – £10

Total = £460

Of course I will eventually buy a lot of this stuff, but an early retirement strategy works on the basis of saving NOW – this means more capital accumulation in the long term. What was it Warren Buffet said.. A dollar spent now is several dollars forgone in the future, or something along those lines.

Strategy Three – Only Food Shopping Once a week

This one was unexpected – but limiting myself to shopping in Sainsburys only once a week (instead of doing an online shop once every two-three months and then nipping in twice a week) seems to be saving me a small fortune – £50 month?!

I’ve also started cooking more cheaply, although not uber-frugally. I might even allow myself the luxury of doing a recipe post at some point. For now I’ll just give a big thumbs up to Dhal and Chapatis (how easy are they!); home made pizza; and vegetable stew (swede is compulsory) with pearl barley – three wonderfully cheap and delicious meals, which are bit of hassle to make but are just FAB!

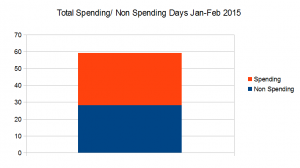

Strategy four – Aiming for more non-spending days than spending days.

This is another strategy I just sort of stumbled on – It prevents me from that kind of idle spending which I used to do compulsively – Nipping out for coffees, or nipping to the shop for munchies – A few quid here and there a few times a week can (and has in the past) easily mount up to £40-50 a month, or £500/ year. Looked at another way, this could mount up to £20K over 40 years – Or nearly a year’s worth of earnings on the median salary, just because of ill-discipline.

This strategy also has the added bonus of making shopping days quite unique experiences. Something to actually look forward and be in conscious control of, rather than something you just passively do without really thinking about it. In fact, I’m not even sure that I’d categorise most shopping as ‘intentional action’. I think I’ll stop there, I’m starting to think hateful thoughts about shoppers, not very Buddhist!

NB – I am slightly behind – so March is going to be an uber-frugal month. I’d always planned it that way anwyays.

–

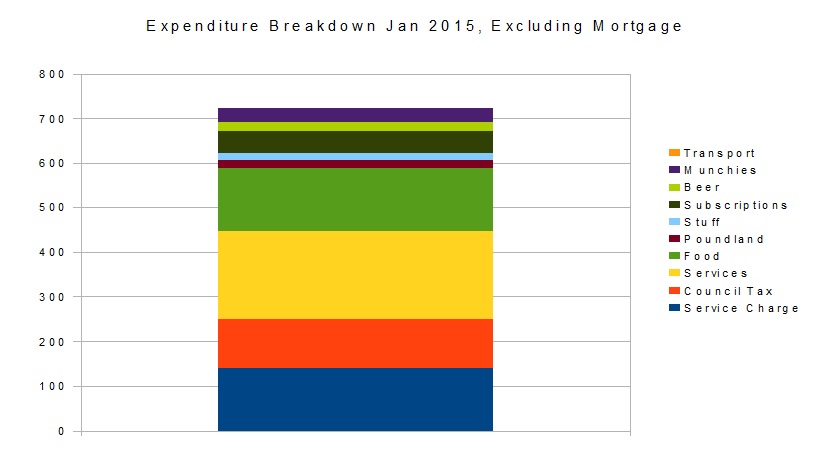

Strategy Five – Keeping track of everything I spend on a day to day basis:

I’m just at the end of month two – I published the first month here. February has actually been quite similar, despite spending £100 on fruit trees and bushes. This is good discipline, But I won’t be publishing anymore until June, just because it gives a more representative and hence valid indicator of overall spending patterns.